Electronic wallets have become more of a reality today than a mere idea. In fact, such is their use that by 2024 the contactless payment method based on NFC technology is expected to have around 1 billion users worldwide.

Among those that stand out the most for their ease of use and number of users are Google Pay and PayPal. With different paths and different life spans, they have established themselves as fixed options. So in this article, we have decided to compare them in terms of operation and benefits.

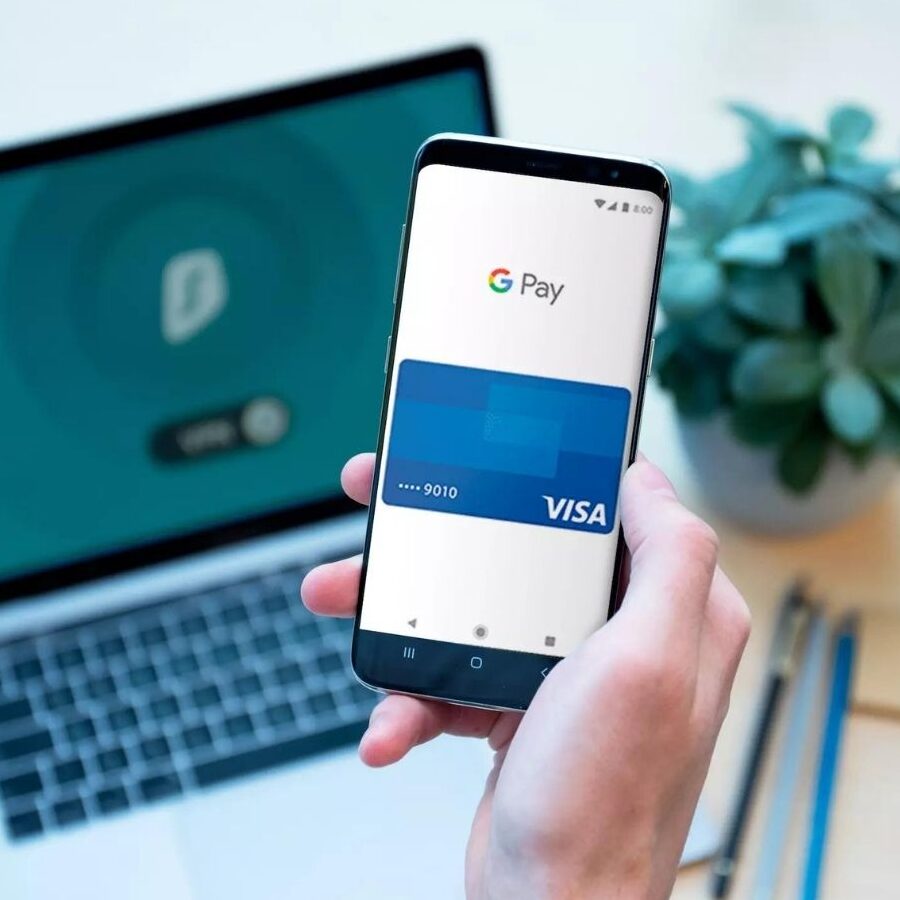

Google Pay, the leading contender

Google’s digital wallet platform came to the market to break everything, to bring a change to a world that at the time was not as consolidated as it is now. Since its launch and after constant optimizations, this platform has not stopped growing to become one of the public’s favorites.

This is thanks to the ease with which you can send and receive money to the cards you have linked securely and as quickly as possible. Available for Android devices such as cell phones, tablets, and smartwatches, as well as for Apple devices.

Google Pay ensures fast, secure, and contactless payments with stores, where not even your card number will be given to the establishments. So it is considered an anti-scam payment method and through constant redesigns, it keeps updating itself to perfect itself.

How to pay with Google Pay?

The operation of Google Pay is simple. By creating an account and bringing your device close to the payment scanner of the location where you want to buy you can start the process. In any case, you only need to select the payment method you would like to use among those compatible with Google Pay.

Once you have chosen this payment method, the Google Pay service will take care of sending the money to the collector. This is done through an automated, secure process that protects your personal data.

To carry out this process you must consider that the NFC reader of the place where you plan to pay must be available. Also, you may be asked to verify certain information such as your signature or PIN linked to Google Pay.

How do I create an account with Google Pay?

Starting a Google Pay account is simple, although you should always consider the different legal restrictions imposed by the country. But it all starts with downloading the application and logging into your Google account.

Once this is done you will have to link the payment methods you want to use with your account. This is something you can do either from the app or from the web portal, and you can also include both cards and your own bank account directly as a payment method.

Once you link the payment method, either through the app or the website, there is not much more to do. Officially, you are already a Google Pay user and you have the availability to make payments using this service.

Benefits offered by Google Pay

In addition to the security and speed characteristic of this contactless payment service, Google Pay has a number of other key benefits for its choice over other methods. These benefits are provided to both customers and merchants.

Convenience

Making use of Google Pay saves you from having to carry around your cards. It’s a convenient act when you feel like making a purchase and don’t have them with you. I mean, who doesn’t have a mobile device with them all the time nowadays?

No fees

For merchants, Google Pay has no per-use fee plans. Giving businesses the opportunity to get the ability to receive an innovative payment method without losing a percentage of their revenue. This is a key point when compared to point-of-sale employment fees.

It’s free

Google Pay is a service that does not charge you any fees or have a subscription cost. So as a user and as a merchant, you can get the most out of it without having to think about how much you are going to have to pay.

Easy to understand and easy to use

On paper, using Google Pay may sound complicated, but it is a system that the more you use, the more comfortable you feel. Once the app is configured, all you have to do is pass your device through the scanner and approve the payment. Something simple compared to classic payment methods.

Now let’s go to PayPal, a classic that remains stable

Undoubtedly the most dominant digital payment platform since its breakthrough in the market in 1998. PayPal, more than a payment alternative, is considered by users as the ideal option to transfer and receive money without direct contact. But what makes PayPal, more than 2 decades after its launch, still dominate the world of online payments?

It is nothing more than the ease of use of a platform that works as an intermediary between your bank accounts and the final destination of the money. PayPal is the ideal way to transfer and receive money whenever you do not want to make direct use of your bank account or do not want to provide your personal information.

How does PayPal work?

As mentioned above, PayPal acts as an intermediary between your bank account and the final destination of the money. It takes care of every aspect of the transaction so you don’t have to provide direct account information.

So once you link your account with PayPal, this system will take care of mediating your transactions whenever you decide. Likewise, PayPal also works as a contact with E-commerces to facilitate transactions whenever the payment methods do not match.

In the same way, PayPal has adapted over time to be used both from the website and from the mobile application. Offering high personal security for all types of transactions you are looking for.

How to create a PayPal account?

Creating a PayPal account is free and the process can be done both from their website and from their app. For this, you will only need to enter your personal information in a process very similar to the creation of a bank account but more simplified.

It sounds tedious compared to other digital cards, but PayPal is responsible for protecting your money directly, so it is not something to be taken lightly. Once the account is generated you will have the possibility to link any of your cards or bank accounts.

Benefits of using PayPal

It’s not for nothing that PayPal has been at the top of digital wallets for a long time now. It is an ideal method for making payments and has some wonderful benefits. Furthermore, it has also become key for international purchases due to its use in different countries.

It is free

Creating a PayPal account is totally free, as well as making transactions through the platform. Except for certain very specific cases or when the limits are exceeded, users will not have to pay any usage fees.

Fraud Prevention

PayPal takes care of encrypting your account information when a transfer is made. So the user receiving the money does not have any personal information about you. Also, if the destination account is fraudulent, PayPal ensures the return of the money.

Ease of online shopping

Unlike other digital wallets, PayPal is accepted for online purchases. This is due to its positioning as a secure and easy-to-use payment method. So do not be afraid to use it as long as it is accepted wherever you want to buy it.

References

-

“Google Pay – Learn What the Google Pay App Is & How To Use It.” Redirecting…, https://pay.google.com/about/.

-

“Google Pay (SE) – Pay in Apps, on the Web, and in Stores.” Redirecting…, https://pay.google.com/intl/en_se/about/.

-

“How PayPal Works.” PayPal, https://www.paypal.com/us/digital-wallet/how-paypal-works.

For years I have studied American finance regulations. All the information in this blog is sourced from official or contrasted sources from reliable sites.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.