Factfile

Name: John Small

Current title: Actuarial Trainee

Company: First Actuarial LLP, Tonbridge, Kent

Course/University: Actuarial Science, University of Kent

John is a member of the Institute and Faculty of Actuaries, which is the UK’s only chartered professional body dedicated to educating, developing and regulating actuaries based both in the UK and internationally.

Q&A

AAC: How did you get the job?

JS: I first heard of First Actuarial in my second year at the University of Kent, when I picked up a copy of the Directory of Actuarial Employers. In my third year, I went to a careers fair organised by the university and spoke to a guy called Tim (who I now sit next to!). He went through with me what they look for in a CV and covering letter. I was fortunate enough to get invited to two interviews and was then offered the job during February. This gave me time to concentrate on my exams and enjoy my summer, knowing that I had a job lined up. There was obviously a bit of luck in this but if you can put in the legwork during the winter of your final year of university, it can definitely pay off.

AAC: What was the biggest change in adapting to work from University?

JS: The biggest change I found when I started work was going from full time study and part time work, to full time work and part time study. When you start studying for the exams it can be nice having a day out of the office, doing something a bit different from your day to day work. However, it can get stressful nearer to the exam when you’re spending a lot of time working and studying. An actuarial student needs to be able to work hard to pass the exams but, as long as you are organised and set time aside to study, it will be very rewarding, and you can still have a life at the same time!

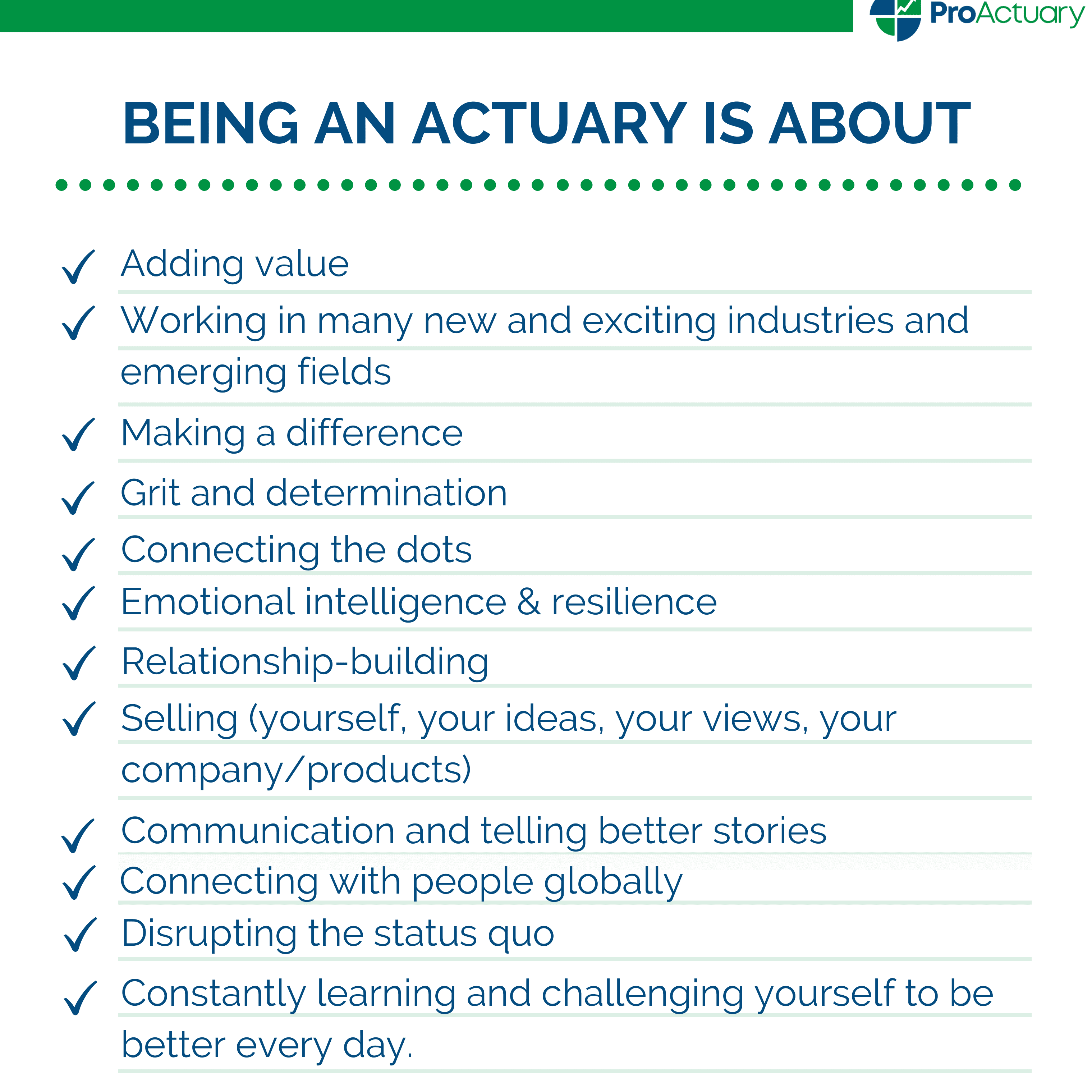

AAC: What are the key soft skills for a consultancy?

JS: Working for a consultancy, communication is a key skill and can be a great asset. If you come into the profession from a mathematical background, there may not have been many opportunities to establish this skill and so any opportunities at university or elsewhere should be taken. I have never been a fan of presenting to people, but I took some opportunities at university to go into local schools and talk about university life and I feel that this really helped me in my interview and has since helped me with my day to day work.

AAC: What do you do day to day?

JS: As you might expect, there are calculations to do. However, a lot of calculations are similar for different clients. Therefore, we have standard software and spreadsheets set up to do these more quickly. A major part of what we do involves writing letters and reports. It’s all well and good calculating the numbers, but we actually need to tell our clients what these numbers mean for them. To do this, we either use template documents or set them up from scratch. This can be a tricky skill at first, but it becomes easier with practice. An important skill is therefore being able to describe potentially complicated concepts in easy to understand language. Overall, a consultant is giving advice. Initially, an actuarial student will have little practice of direct contact with clients, but as they get more senior, this becomes more of everyday work. This might involve emails and phone calls, or it might involve more face to face meetings.

For years I have studied American finance regulations. All the information in this blog is sourced from official or contrasted sources from reliable sites.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.