It’s not unusual if you’ve ever wondered, “Is there any 5/3 bank near me?” because it is a regional financial institution headquartered in Cincinnati, Ohio. Founded in 1858, this Bank has experienced steady growth over the years, becoming one of the largest and most respected banks in the United States.

They have a strong presence in the Midwest and Southeast, offering a wide range of financial products and services, including personal banking, business banking, lending, investments and wealth management. In addition, the Bank has demonstrated a commitment to corporate social responsibility and sustainable development, encouraging its customers and employees to adopt green practices and support charitable causes.

5/3 Bank near me in Orlando

Like most banks, 5/3 Bank opens its doors to the public in Orlando at 9 AM. At this time, you can go to any of the following locations. Please note that they work until 5 PM.

5/3 Bank closest to me in Illinois

It is well known that 5/3 Bank does not have a presence in many parts of the United States, but, to your good fortune, Illinois is included among its locations. We have selected some of the best locations where you will receive first-hand attention to solve any eventuality with your account.

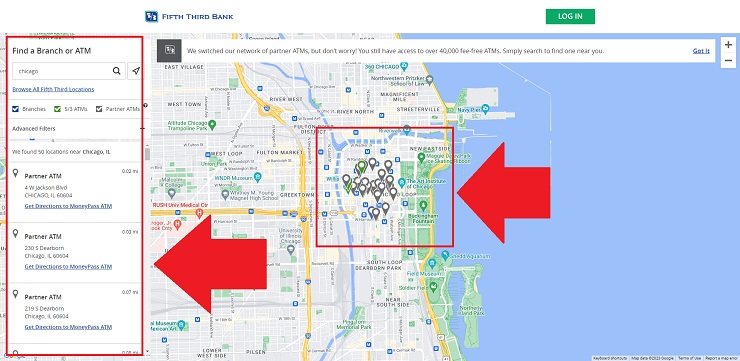

How to get a 5/3 bank near me?

- The first thing to do is to go to the Bank’s official website.

- Then, locate the branch locator, which is located on the top right-hand side of the home page; you will find a magnifying glass icon next to it which says “Branch & ATM locator”.

- Here you will see a map with an option to search for your city by name, state or zip code. Enter the information.

- You will now see the results for the city you have chosen. You can detail the hours and information for each branch.

How many 5/3 Banks are near me in the United States?

With more than 160 years of history, this Bank is proud of how much it has grown and expanded its reach in the country, establishing itself as a key player in the banking industry.

It has approximately 1,100 branches in 10 states, primarily in the Midwest and Southeast. These states include Ohio, where it is headquartered in Cincinnati, as well as Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia, and North Carolina. In addition, the Bank operates more than 2,400 ATMs, making it easy for its customers to access cash and other banking services at any time.

5/3 Bank’s extensive branch network enables its customers to enjoy a variety of financial products and services, including checking, savings, mortgage loans, auto loans, credit cards, investments, wealth management, and more.

Is 5/3 Bank an international bank?

If you are wondering if 5/3 Bank is an international bank, it is important to note that its primary focus is the U.S. market. However, the Bank does offer certain financial services and products globally.

Although most of its branches and ATMs are located in 10 U.S. states, 53 Bank provides international financial solutions through its corporate and commercial banking services division.

This division specializes in offering products and services to assist companies in their international operations, including trade finance, foreign exchange risk management, foreign currency payment and collection solutions, and trade finance services. In addition, it has banking relationships around the world that enable its clients to access financial services abroad.

Despite its primary focus on the U.S. market, it demonstrates a commitment to innovation and adapting to the needs of its clients in an increasingly globalized world. By offering international financial solutions, the Bank positions itself as a valuable resource for businesses and individual customers who require access to financial services beyond the borders of the United States.

What is the international fee for Fifth Third Bank?

This Bank provides several financial services, including those with international fees. If you are wondering what the international fee is for Fifth Third Bank, it is important to note that fees may vary depending on the type of service or product you require.

Debit and Credit Card Transaction Fees

When making international purchases with your debit or credit card, you may be charged a foreign currency transaction fee. The international foreign currency transaction fee is usually a percentage of the total transaction amount, which may vary depending on the type of card you have. For example, some 53 Bank credit cards charge a 3% foreign currency transaction fee.

International Money Transfers

When sending or receiving money internationally through Fifth Third Bank, additional fees may apply. These fees may vary depending on the amount you are transferring and the country to or from which you are sending money. In addition, it is essential to note that international transfers may also be subject to additional exchange rates and fees.

International Commercial Banking

If you are a Commercial Banking customer and require international financial services, such as trade finance, foreign currency payment and collection solutions, or foreign trade services, specific fees may apply for each service.

Why is Fifth Third a good bank?

There are several factors that make this prestigious financial institution one of the best banks. For example, the wide presence in its territory makes people become customers of this reputable Bank.

Variety of services and products

Provides a full range of financial products, including checking and savings accounts, loans, credit cards, investments and wealth management, to meet the needs of its customers.

Technology and innovation

Strives to remain at the forefront of technology and innovation, implementing digital solutions that facilitate the management of its customers’ finances, enhancing security, and offering resources and tools to promote financial education. These efforts reinforce the Bank’s position as a modern, customer-oriented bank.

Customer service

While the quality of customer service may vary by location and individual experiences, this financial institution prides itself on maintaining a high level of customer service and satisfaction. In addition, the Bank can use customer feedback to continually improve its services and customer care.

Banking for all

They are 100% committed to financial inclusion and offer programs and products for underserved communities, promoting access to affordable, quality banking services when you require it.

Can I use Zelle with Fifth Third Bank (5/3)?

Yes, customers can use Zelle, a digital money transfer service that allows them to quickly and securely send, receive and request money directly between U.S. bank accounts. To access Zelle, customers can use the online banking platform, without the need to download a separate Zelle application.

To begin using Zelle, they must register their email address or cell phone number in the mobile app or online banking. This process links the customer’s contact information to their bank account, allowing transactions to be made through Zelle. To send money, customers must select a recipient using their email address or cell phone number.

The Bank does not charge additional fees for using Zelle to send or receive money between U.S. bank accounts. However, it is important to check the Bank’s terms and conditions for possible changes in fees and policies.

Zelle uses advanced security measures to protect transactions, such as multi-factor authentication and data encryption. In addition, since transactions occur directly between users’ bank accounts, there is no need to share sensitive banking information with third parties.

Does Fifth Third Bank (5/3) have monthly fees?

Fifth Third Bank provides a variety of bank accounts, each with its own monthly fees and requirements. Some accounts have monthly maintenance fees, while others may waive these fees if certain requirements are met, such as maintaining a minimum balance or performing specific transactions.

For example, the Essential Checking account may have a monthly maintenance fee, but it can be waived by maintaining a minimum daily balance or making a monthly direct deposit. It is significant to review the terms and conditions of each account for applicable fees and how to avoid them.

For years I have studied American finance regulations. All the information in this blog is sourced from official or contrasted sources from reliable sites.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.