The Charleston County tax estimator can estimate the taxes that may be applied on real estate parcels, personal property, or motor vehicles.

As we will see below, the results are based on the parameters the user enters in this estimator. It is a web platform that will require filling in a series of fields to provide the requested information.

What is the Charleston County tax estimator?

It is a web platform you can access with this link, allowing you to make estimated calculations of the cost of taxes in this county.

We should note that entering a series of data requested by this tool is necessary to obtain the calculation. The data are grouped into two blocks:

General data block:

- Fiscal year

- Tax District

- Appraisal value

- Assessment ratio

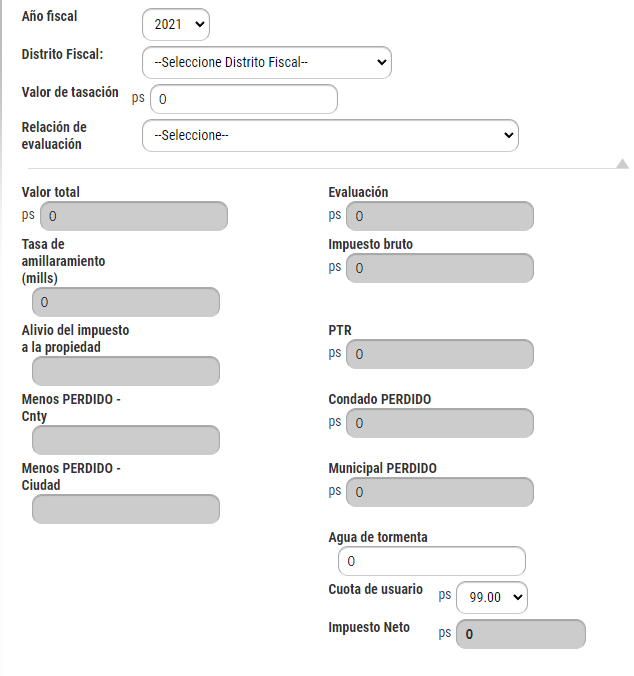

On the other hand, a general data block is applied to the property, real estate, or vehicle for which you want to extract information. It represents more than a dozen of data, as we can see in the following image:

An important thing to remember is that in no case is the result of this estimator considered a final result. That means that it is not always a conclusive result, even if you get an estimate of your possible taxes.

How is the process performed?

To correctly perform this process of estimating your taxes in Charleston County, you must follow a series of steps. Let’s go over the most important ones:

First, you must select the area in which your property is located: you can do this from the drop-down where the tax districts are included.

Once you have done this, you can include the property’s appraised value. You must select the correct appraisal rate from a drop-down menu. Notice that in that drop-down menu, the percentages are different:

- 4% for principal residences

- 6% for non-principal residences or other real property.

- 6% for motor vehicles

- 10.5% for personal property

The next step is to include or select rates that are appropriate for stormwater (if this is the estimate you are making):

- $72 on improved parcels within unincorporated areas.

- $60 on all improved parcels located in Mt Pleasant.

- $72 on all improved parcels located in North Charleston

Meanwhile, the corresponding fees for other types of declarations are as follows:

- $99 for improved real property.

- No cost for unoccupied real property and unoccupied motor vehicles.

How to contact the auditor’s office in Charleston County?

There are different ways through which you will be able to contact the auditor’s office to make your inquiries. Remember that, in any case, the website can offer a lot of information in addition to the estimation tool.

If you would like to visit the office, the mailing address is 101 Meeting Street PO Box 614 Charleston, SC 29402-0614.

Alternatively, you can also call (843)958-4200 or send an email to one of the various addresses available:

- personalproperty@charlestoncounty.org

- watercraft@charlestoncounty.org

- realproperty@charlestoncounty.org

Within the web platform, in addition to accessing tax information directly or making an estimate, you can also carry out other important actions.

For example, it is possible to pay taxes and view records: you can obtain personal property tax information, pay taxes through the Internet and obtain real estate tax information.

Another tool is the possibility of requesting a tax bill for the vehicle. That may occur in cases such as needing a license plate for a new car or if you have moved to this county from out of state. It will also be possible to add other information such as address changes, out-of-state tag reports, or Homestead exemption.

For years I have studied American finance regulations. All the information in this blog is sourced from official or contrasted sources from reliable sites.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.