Santander is one of the largest banks in the world, with a significant presence in Europe, Latin America and the United States. It’s not uncommon to wonder, “Is there any Santander bank near me”? Founded in Spain in 1857, it has grown into a global financial institution offering a wide range of banking products and services, including loans, mortgages, savings accounts, credit cards and much more.

It is distinguished by its focus on innovation and technology and is committed to sustainability and corporate social responsibility. With an extensive network of branches and ATMs around the world, it is always close to its customers, offering them personalized financial solutions tailored to their needs.

Santander Bank nearest me in New York

Santander Bank is international, and in the Big Apple, it could not be missing. In New York, you can find many branches of this great bank, but here are ten of the best options. You can visit them starting at 9 AM.

Santander Bank closest to me in Philadelphia

Anyone living in Philadelphia will have the opportunity to open a bank account at Santander Bank or even resolve any problems with their accounts. Here are the ten locations we have chosen for you:

How to find a Santander bank near me?

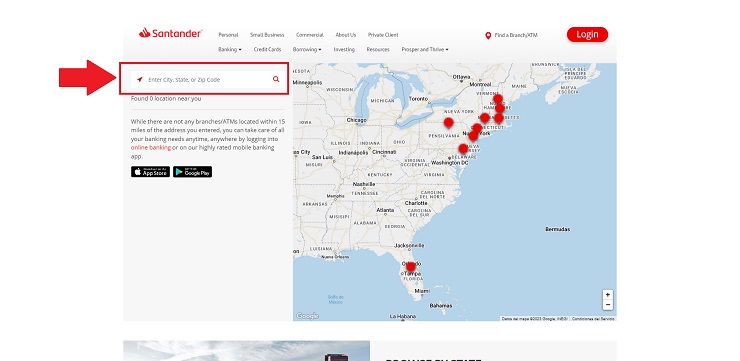

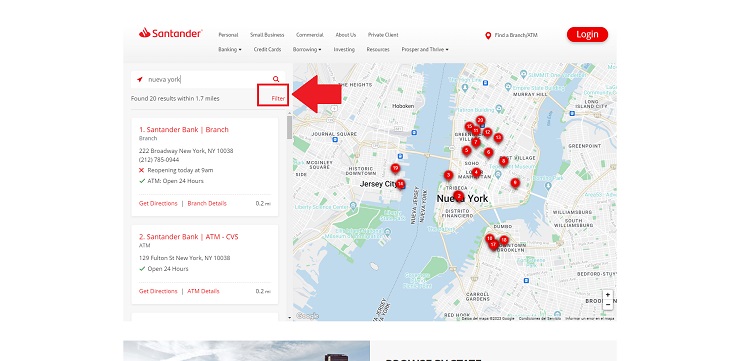

- Open your web browser and go to the official website of Banco Santander.

- Look for the “Find a branch” section and click on the “Find a branch” button.

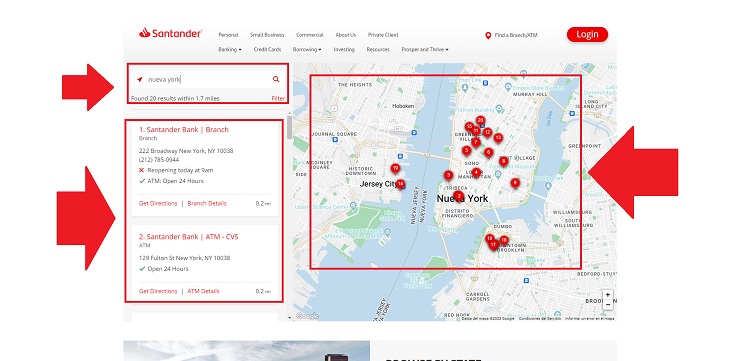

- On the search page, you can enter your current location, such as your city or zip code, to find the branch closest to you.

- When you get the results, you will see the address and hours for each location. In addition, you can click on the “Branch details” option for more details.

- In addition, you will see below the search bar the word “Filter“. By clicking on “Filter, you will have the option to filter the search between ATM or Branch. In addition, you can also filter by the services you require.

How many Santander Banks are there near me in the United States?

Santander Bank has a network of branches and ATMs in several states on the East Coast, including Massachusetts, Rhode Island, Connecticut, New York, New Jersey, Pennsylvania and Delaware. As of September 2021, Santander Bank operates 424 branches and more than 2,000 ATMs in the United States.

The bank has established a strong presence on the East Coast of the United States through a series of strategic acquisitions, including Sovereign Bank in 2009 and Popular Community Bank in 2018, which has allowed it to expand its branch network and banking services in the region. Similarly, they provide online banking services, which facilitates access to their banking services anywhere in the country.

It also has a significant presence in Latin America and Europe, where it operates as Banco Santander. Globally, Banco Santander is one of the largest banks in the world, with a wide range of banking products and services for individuals and businesses.

Which Banks are linked to Santander?

Moreover, this bank has numerous partnerships with other banks and financial institutions around the world. A bank that has earned its place over the years and continues to hold its own among the world’s other banks.

In Spain, it is the main shareholder of the investment and asset management bank Santander Asset Management. It is also the majority owner of the online bank Openbank and the private banking division UBS Spain.

Internationally, it has partnerships with several banks and financial institutions. In Mexico, it has a partnership with Banco Nacional de Mexico (Banamex), which is called Citibanamex. In Brazil, it is the majority owner of Banco Santander Brasil, and in the United Kingdom, it owns the consumer bank Abbey National.

It has partnership agreements with other banks and financial institutions around the world, such as Bank of America in the United States and the Chinese Industrial and Commercial Bank of China (ICBC).

How do I open a Santander bank account in the USA?

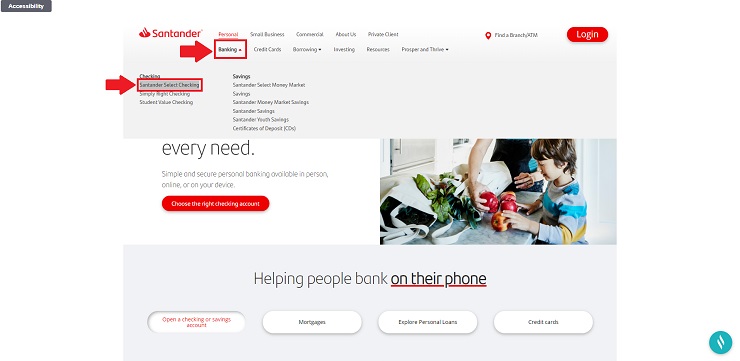

- Log in to the Santander website.

- Seek the option “Banking” > “Santander Select Checking”.

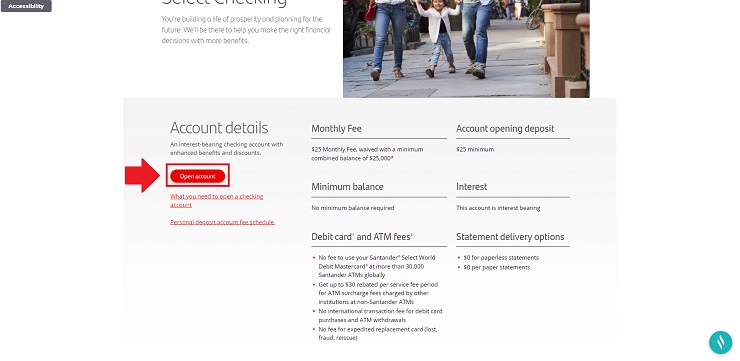

- Now click on “Open Account” and follow the steps.

- Generally, you should read the terms and conditions of the account you have selected, making sure you understand the requirements and associated costs.

- You should also complete the application form with your personal and financial details. In this step, you may need to provide official identification and proof of address.

- Now verify that all the data entered is correct and submit the application.

- Wait for the bank to process your application and contact you to confirm the account opening.

Does Santander Bank do international banking?

Banco Santander’s international banking services include foreign currency accounts, international transfers, international credit and debit cards, and foreign exchange services. It also has an extensive network of branches and ATMs around the world, which facilitates access to banking services for international customers.

It has a digital banking platform, which allows customers to conduct banking transactions from anywhere in the world, as long as they have access to the Internet. Customers can review their accounts, make transfers and pay bills online, making it easy to manage their finances from anywhere in the world.

Benefits of Santander Bank in the United States

They have a large repertoire of benefits so that their wide range of customers obtain a high degree of satisfaction when choosing this bank. Many people choose this bank because of its long history of operation (since 1857).

Extensive branch and ATM network

They have an extensive network of branches and ATMs in a large part of the United States, which facilitates access to banking services for all customers within the country.

Credit and Debit Cards

Credit cards include options with competitive interest rates, rewards programs, travel insurance and purchase protection, among other benefits. On the other hand, debit cards allow online and in-store purchases, and cash withdrawals from ATMs, and some have additional benefits, such as discounts at affiliated establishments.

Personal and business loans

These allow the customer to enjoy competitive interest rates and flexible terms that adapt to the customer’s needs and payment capabilities. In addition, customers can request loan amounts ranging from a few hundred dollars to several thousand dollars, depending on their credit profile and repayment capacity.

Rewards Program

Banco Santander customers in the United States can participate in the Santander Rewards program, which offers points for each credit card purchase that can be redeemed for travel, products and services.

Online Banking

It undoubtedly offers numerous benefits to its customers; such as the possibility of carrying out banking transactions from any place and at any time, consulting balances and movements, paying bills, applying for loans, and accessing investment and financial advisory services, among others.

For years I have studied American finance regulations. All the information in this blog is sourced from official or contrasted sources from reliable sites.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.