Wells Fargo Bank is a well-known financial institution that offers a wide range of banking services to customers throughout the United States. So you’ve probably asked yourself at some point, “Is there a Wells Fargo Bank near me?” to which the answer is undoubtedly yes, since this bank is present in hundreds of locations across the country.

Whether you’re looking to open a checking account, apply for a mortgage or simply withdraw cash from an ATM, Wells Fargo Bank has you covered. Their branches offer a variety of services, including personal and business banking, investment advice and wealth management. Plus, with their online and mobile banking options, you can manage your accounts from anywhere, anytime.

Wells Fargo near me in Los Angeles

Wells Fargo is a very popular bank throughout the United States. Therefore, we leave you with ten of the most prominent branches in Los Angeles. Their opening hours are from 9 AM to 5 PM.

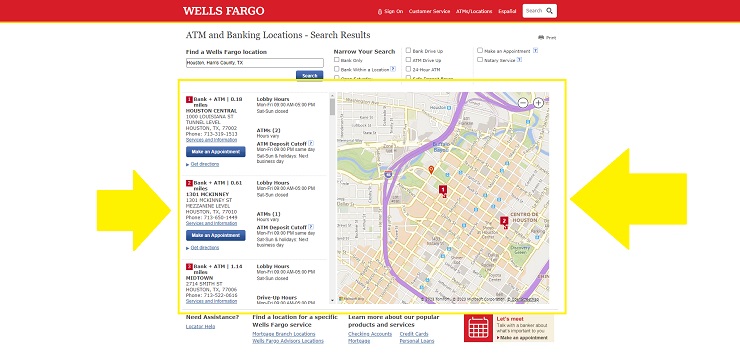

Wells Fargo nearest me in Houston

In the case of Houston, there are also many branches, but the best thing is that some branches are open 24 hours a day because of the ATMs:

How to find Wells Fargo Bank near me?

- Finding a Wells Fargo branch near you can be easy because the bank is very present in the United States. That is why through their website, they offer the possibility to find branches near your location.

- On their website, on the top right, you will find the “Locations” button that offers the opportunity to find specific branches.

- Once there, you will be presented with a mini-map of the states where there is a Wells Fargo branch available.

- Similarly, in the search engine located at the top of the page, you can include the address, zip code or state where you are located to be shown the branches.

- This search engine offers the possibility of filtering the branches according to the economic needs you have

- When you choose the characteristics of your search, the search engine will show you the different possibilities of stores in the area you are looking for. This, together with specific data about the branch, such as contact methods and exact address

How many Wells Fargo branches are there near me in the United States?

Wells Fargo is one of the largest banks in the United States, with a long history of providing banking and financial services to customers across the country. It was founded in 1852 in San Francisco and has since grown to become one of the “Big Four” banks in the United States, along with JPMorgan Chase, Bank of America and Citigroup.

As such, Wells Fargo has about 7,000 bank branches in the United States. Strategically located in most of the states of the country, although not necessarily in all of them. Similarly, Wells Fargo has an even larger ATM network, which seeks to meet the financial needs of its many customers who choose it as an ideal option in the United States.

Wells Fargo has more than 13,000 ATMs nationwide. This extensive network of branches and ATMs makes it easy for Wells Fargo customers to access their accounts and conduct banking transactions nationwide. In addition, Wells Fargo’s online and mobile banking option allows customers to manage their accounts and bank from anywhere, anytime.

What are the banking services offered by Wells Fargo?

One thing that has led this banking chain to be considered one of the “Big 4” is the wide range of banking services offered to meet customers’ needs, filling a list of options that pose the bank as a secure option for different specialized services. These services include:

- Checking and savings accounts: it has a variety of checking and savings accounts for individuals and businesses, each with different features and requirements

- Credit and Debit Cards: has a range of credit and debit cards that offer benefits such as cash rewards, points, frequent flyer miles and more

- Personal and Business Loans: Includes a variety of loans to meet the financing needs of individuals and businesses

- Mortgages: Wells Fargo is one of the largest mortgage lenders in the United States and offers a wide range of mortgage loan options, including fixed and adjustable loans

- Investments and wealth management: The company has investment and wealth management services, including financial advice, portfolio management, and financial planning

- Insurance: has a wide range of insurance options, including life, home, auto, and business insurance

In addition to these core banking services, also offers several additional services, such as online and mobile banking, money transfer services, and treasury management.

Wells Fargo’s international presence

Although Wells Fargo is one of the largest banks in the United States, its international presence is relatively limited. Wells Fargo has some branches and offices abroad, primarily in Canada, Mexico, the United Kingdom, Asia and Latin America, but its primary focus remains on the U.S. market.

In terms of international banking services, this bank offers several solutions for customers doing business abroad, such as international money transfers, foreign exchange services and commercial loans for companies operating in other countries. However, its international presence is smaller compared to some other major global banks.

Recently, it has been trying to expand its work function internationally, trying to reach new markets to explore. Currently, Wells Fargo has branches in more than 35 countries around the world, including Canada, Mexico, the United Kingdom, Germany, France, Spain, Japan, China, Singapore, India and Brazil, among others.

How does the Wells Fargo rewards programs work?

The bank offers several rewards programs for its credit cards, which allow customers to earn points, miles, or cash rewards for purchases made with their cards.

In general, Wells Fargo’s rewards programs are easy to use and offer a wide range of point or reward redemption options. Customers can view their points or rewards balance online and redeem them for the reward of their choice at any time.

Go Far Rewards

This Wells Fargo rewards program allows customers to earn points for every dollar they spend on their credit cards. Points can be redeemed for a wide range of rewards, including travel, gift cards, merchandise, cashback and more.

Cash Wise Rewards

This program gives customers a percentage of cash back for each purchase they make with their credit card. The cashback percentage varies by card but can range from 1.5% to 1.8% for each purchase.

Propel Rewards

This rewards program is designed for frequent travelers and allows customers to earn points for every dollar they spend on travel, dining, gas and other travel-related expenses. Points can be redeemed for a wide variety of rewards including cash back, giftcards, travel, and more.

For years I have studied American finance regulations. All the information in this blog is sourced from official or contrasted sources from reliable sites.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.