Business owners who want to form an LLC should be familiar with Form 568; it is the income reporting document for most limited liability companies in California.

All LLCs classified as unclassified entities or partnerships must file this form along with Form 352 with the California Franchise Tax Board.

Instructions for Completing Form 568

Form 568 contains the income, coverages, withholdings, taxes, and all financial items of your private limited liability company or LLC. To fill it out, you must pay close attention to each line.

The document’s first line shows the total income from Schedule IW, where you must put the total revenue. The next line is for the limited liability company fee; you must add the amount of the LLC fee.

The fee must be paid when the total income equals or exceeds $250,000; you should not place your franchise tad on this line. On the next line is the annual tax on limited liability companies; here will go the yearly tax of $800.

Line four is the tax liability for nonresident nonconsenting members; the information you should enter is the total tax calculated on Schedule T on side 4 of form 568.

Line five is for the partnership level tax; it will go to any California tax changes that result in audit adjustments at the federal partnership level; if not applicable in your case, leave the line blank.

Next, you must enter the total tax and fee; add what is entered on lines two and five. Now, on line seven is the amount paid with FTB Form 3537, FTB Form 3522 of 2022, and FTB Form 3536.

If your LLC is classified as a “nonresident owner,” you must consent by defining yourself as “partners, Shareholders or members who do not reside in California, plus beneficiaries of an estate or trust who are not California residents.”

If you choose that option, the amount is entered on line 15e of Schedule K – 1 of your LLC. Moving to line 8, you will find the overpayment, here will go any overpayment made the previous year that will be taken as a credit.

The withholding is on line 9; when a group of individuals manages the LLC, you can apply some or all of the withholding credit to its members or conversely claim the portion on line 9, but it cannot be more than the tax and fee due.

Check the following figures appropriately

On line ten, you should enter the same as on lines seven, eight, and new to get the total payments. Next is the use tax; if you purchase products out of state and do not pay sales and use tax, you should enter the purchases here.

The balance of payments is on line twelve; if the total payment figures are greater than the use tax, you must subtract the tax from the total costs. On the next line will go the balance of the use tax, you must do the same procedure as above, but you will subtract the total payments from the use tax.

The procedures of the following lines are the same; you must only pay attention to make the additions and subtractions indicated in the refund line on payment, taxes, and charges due.

Finally, there will be the penalties and interests; here, you must place your LLC’s liabilities, claims, and, ultimately, the amount owed.

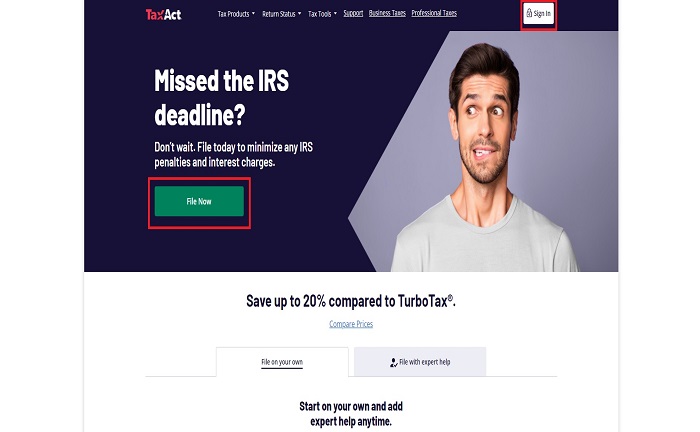

How to access form 568?

By accessing Taxact.com, create your account or log in to find your return online and start the process.

Then you must go to “State” and search for “California or CA.” Here you go to Single Member LLC Filing; the option is in the quick menu and will be “+Add Form 568”.

This way, you can create a new copy of the form, and you have to click on “Edit” to start adding all the information with the steps mentioned above. You should save all the changes before closing the page when all the reports are added.

In case of any inconvenience, it is advisable to contact the service and support through taxact.com. You can ask one of the agents for help if you have problems with your form.

For years I have studied American finance regulations. All the information in this blog is sourced from official or contrasted sources from reliable sites.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.