Encountering any of the IRS codes usually generates a lot of confusion among users; it is difficult to understand whether it is a good thing or not. In addition, searching the internet is typically a not-so-profitable idea; you do not always find effective solutions.

One of the common codes is 150; but what is tax code 150? what is code 150 on irs transcript 2022? when irs code 150 on transcript 2022 appears for the first time, it is common to feel confused and worried. Without a quick explanation, it is often believed that the 150 meaning code is something wrong or that one of the procedures is executed improperly. So, what does code 150 mean on irs transcript 2022? which is the code 150 on irs transcript 2023?

The meaning of IRS code 150

If you have received “Code 150 on IRS transcript in 2022” it means that the IRS has processed your tax return and determined your tax liability. According to the U.S. Internal Revenue Service, tax code 150 can mean two things. The first is that there is a tax return filed code 150 and tax liability assessed, and the second is due to an entity created by TC 150.

In either case, the code 150 IRS indicates that the return was successfully processed even though you have not yet received any notification. This approval means you will receive your refund through any of the authorized channels you request.

Now you need to keep an eye on your bank account, email, or any third-party mobile finance app where you can receive the money. However, if you have a positive number on your code 150 irs with amount, it indicates that you owe that amount of money.

What is the significance of code 150 on the IRS transcript?

Many people wondered about code 150 on irs transcript 2021. Users commonly evaluated this 150 code IRS (150 tax code) on their transactions; it indicates that your tax return has been filed and your tax liability has been established. Along with the 150 tax return filed, this 150 IRS code shows only taxes due before withholding and credits were applied.

Now, if you notice this tax code 150 with date (in the future), code 150 with amount, or code 150 irs with no amount, you will need to contact the U.S. Internal Revenue Service for more information on what it means.

Verification of the transcript through “Where’s my refund?”

One effective option to keep track of your refund is “where’s my refund?”; it is a platform specially designed to know the approximate dates when you will get your refund.

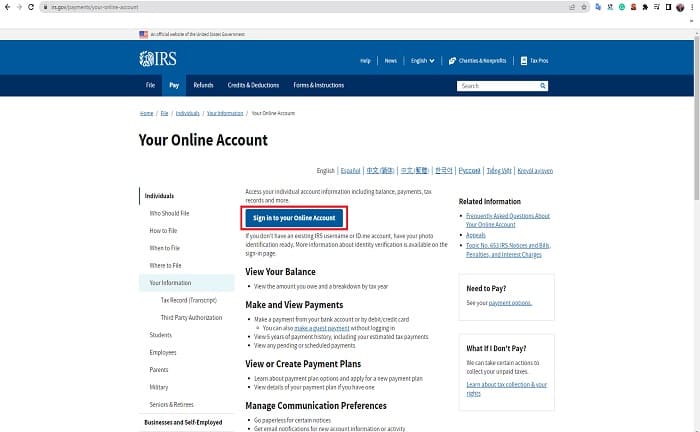

It is the most accurate method you can find today. To start using it, you must go to the IRS website and log in with your account. If you pay taxes, you will probably have one where you monitor your IRS 150 code status.

Once inside your account, you will see the “What happened to my refund” option. When you click on it, you will see all the necessary information about what does tax code 150 mean, the process, and the date your refund will be deposited. You can review this section whenever you wish.

In case of any change, the IRS will be the first to inform you about the situation and the procedures to consider obtaining an effective solution in the corresponding term.

What is code 150 on IRS transcript 2023?

As with the 150 code on tax transcript 2022, IRS code 150 on transcript 2023 signifies that the IRS has completed processing your tax return for that year and has calculated your total tax due. The tax code 150 meaning is that they have reviewed your income, deductions, credits, and other tax information, and have determined how much tax you owe for the year.

In addition to calculating your 150 code tax due, the IRS also applies any credits on your account to this tax code 150 with amount. These credits could include federal tax with holdings from your paycheck throughout the year, estimated tax payments you made, or other tax credits you may be eligible for. These credits are subtracted from your total tax due to calculate your final balance. If your credits exceed your tax due, you may be due a refund.

IRS tax code 150 will appear on your account transcript throughout the entire processing stage of your tax return. This means that from the time the IRS receives your return until they finish processing it, you can expect to see tax code 150 on transcript.

Along with +150 code, you may also see a cycle code on your transcript. This is an 8-digit number that indicates when your tax return was posted to the IRS Master File, which is the IRS’s official record of your tax account.

What does account balance mean on IRS transcript?

Now that you know what is code 150 on tax transcript, it’s important to learn about the term “account balance” on an IRS transcript code 150. It represents the net code 150 with amount and date that you owe to the IRS or that the IRS owes to you. This balance is calculated based on the information in your tax return, taking into account any adjustments to your return, payments you’ve made, credits you qualify for, and any penalties incurred.

You will have a positive balance if the sum of your payments and credits exceeds your tax liability and any penalties (indicates that the IRS owes you a refund). On the other hand, if your tax liability and any penalties are greater than the sum of your payments and credits, you will have a negative balance with a tax code 150 with future date, which indicates that you owe money to the IRS.

For years I have studied American finance regulations. All the information in this blog is sourced from official or contrasted sources from reliable sites.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.